Mastering Stablecoins:

A Practical Guide to Sustainable Yields

From theory to practice: explore stablecoin basics, including types and risks, with proven strategies, and a curated selection of current yield-bearing protocols.

Most people still believe crypto is purely speculative, with no real-world use cases beyond risky investments. Our team at DefiDeviants™ has conducted extensive research on stablecoin protocols to demonstrate their practical applications - specifically how they enable yield opportunities with quantifiable returns and defined risk parameters.

Research Methodology & Content Overview

This analysis is based on empirical data collection and protocol evaluation. Below is our research approach and what you'll explore in each section:

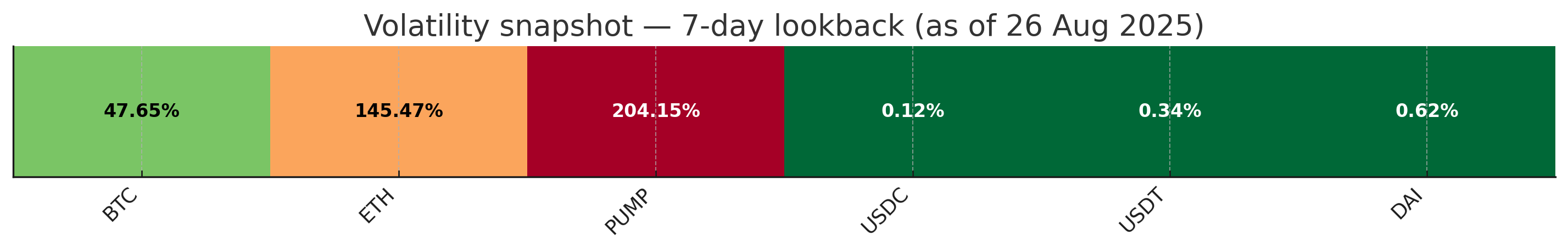

- Stablecoin Fundamentals: Definitions, volatility comparisons, and practical use cases with visual heatmap analysis

- Stability Mechanisms: Comprehensive breakdown of fiat-backed, crypto-collateralized, algorithmic, and RWA-backed designs

- Risk Framework: Systematic analysis of failure modes based on historical precedents and current market conditions

- Strategy Classification: Seven distinct yield generation mechanisms, from basic lending to advanced market-making strategies

- Market Analysis: Comparative volatility studies, protocol yield tracking, and regulatory impact assessments

- Historical Protocol Evaluation: Assessment of both established (Aave, Morpho) and emerging protocols (Resolv, Katana)

- Forward Analysis: Future infrastructure development impacts, including Plasma blockchain integration

Our goal is to both onboard beginners into stablecoin yield generation and to introduce newly emerging opportunities to experienced users. Our research is designed to be accessible, with clear explanations and direct links to protocols.

We evaluated over 100 stablecoin protocols, detailed 15+ high-potential yield opportunities, and leveraged insights from major de-peg events to guide your informed decisions.

Last updated: August 29, 2025 — APRs, protocol information, and market conditions are subject to frequent changes in this rapidly evolving DeFi landscape.

What Are Stablecoins?

Stablecoin (noun) - /ˈsteɪblkɔɪn/

A cryptocurrency designed to maintain a stable value by pegging its price to another asset, such as a fiat currency (USD, EUR), a commodity (gold), or through algorithmic supply management.

Many people hesitate to hold cryptocurrencies like Bitcoin due to their significant price volatility - and we get it. Stablecoins like USDC, Tether (USDT), EURC, USDE, and DAI address this concern by maintaining a constant value-such as 1 USDC ≈ $1 or 1 EURC ≈ €1. Think of them as cash on the blockchain. See the volatility heatmap comparing stablecoins with more volatile assets like Bitcoin ($BTC), Ethereum ($ETH), or even emerging tokens like $PUMP.

Data snapshot: 7 daily closes ending 25 Aug 2025 (Europe/Paris). Method: daily log-returns, annualised by √365. Assets shown (annualised σ): BTC 47.65%, ETH 145.47%, PUMP 204.15%, USDC 0.12%, USDT 0.34%, DAI 0.62%. This stability snapshot comes before any DeFi APR figures below.

So, if the price doesn't fluctuate, what's the point? Stablecoins enable everyday use cases-making purchases via crypto debit/credit cards and sending/receiving payments globally. However, the real game-changer is their role in decentralized finance (DeFi), offering interest opportunities often higher than in traditional finance (TradFi). Of course, these opportunities come with their own unique risks, which we cover next.[1]

How Stablecoins Stay Stable: Types & Pros/Cons

Stablecoins are only valuable if they hold their peg. Different designs achieve this in different ways:

- Fiat Reserve-Backed (e.g., USDC, USDT) - Backed 1:1 by cash or short-term Treasuries held with regulated custodians. Peg maintained via redemption arbitrage: if price drops, buy cheap and redeem; if price rises, mint and sell.

- Crypto Over-Collateralized (e.g., DAI, LUSD) - Users lock excess crypto as collateral; liquidations keep positions safe and the peg aligned.

- Algorithmic / Synthetic (e.g., FRAX, USDe) - Smart contracts and strategies (e.g., delta-neutral hedging) adjust supply/exposure to keep value stable; confidence-sensitive.

- Tokenised RWA-Backed (e.g., USDY, PAXG) - Backed by real-world assets (gold, Treasuries) with redemption links to the underlying.

| Category | How the Peg Works | Examples | Pros | Cons / Risks |

|---|---|---|---|---|

| Fiat-backed ("custodial") | Redeemable 1:1 for fiat/Treasuries via regulated custodian | USDC, USDT, PYUSD | Simple, tight peg, regulatory clarity | Trust in issuer, blacklisting risk, issuer earns reserve yield[3][4] |

| Crypto-collateralized | Overcollateralized loans on-chain | DAI, LUSD, crvUSD | On-chain transparency, censorship resistance | Capital-inefficient, exposed to crypto volatility |

| Algorithmic / Synthetic | Peg via arbitrage, rebasing, or hedging | FRAX, USDe | Capital-efficient, often yield-bearing | Complex, confidence-dependent, historical failures |

| Commodity / RWA-backed | Backed by gold, Treasuries, etc. | PAXG, USDY | Diversification, real yield, TradFi-DeFi bridge | Custody/audit risks, redemption friction |

Key Risks

Stablecoins are often seen as "safe," but whether you hold them or use them to generate yield, several risks can lead to capital loss. Below are the most common vectors.

De-peg Risks

A de-peg occurs when a stablecoin no longer trades at its intended value relative to the asset it tracks. For a dollar-pegged coin, a drop to $0.98 or lower constitutes a de-peg. De-pegs can follow market shocks (liquidity shortages, cascading liquidations) or structural weaknesses, and the causes vary by design (algorithmic, fiat-backed, RWA-backed, …).

Examples of Previous De-pegs

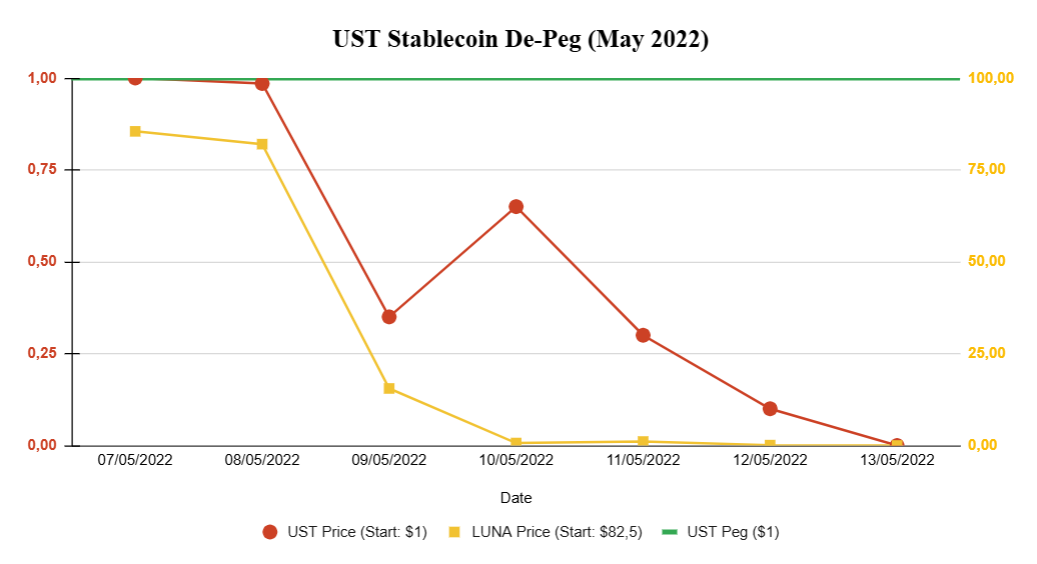

1. UST (TerraUSD) - An algorithmic stablecoin (= not backed by any real assets) pegged to $1 via an arbitrage link with LUNA, Terra's native token.

How it worked:

- 1 UST could be converted to $1 worth of LUNA at any time.

- If UST > $1, users minted UST from LUNA to push the price down.

- If UST < $1, users burned UST for LUNA to reduce supply and push the price up.

How the mechanism broke:

Trust held the peg. Anchor Protocol, the main protocol on Terra, offered 20% APY on UST deposits. In early 2022, sustainability concerns mounted; in May 2022 a governance proposal reduced APY from 20% to 18%. Combined with bear-market conditions, outflows accelerated. Redemptions for LUNA ballooned supply; trillions were minted within days, sending LUNA from $80+ to under a cent. A death spiral drove both UST and LUNA to ~zero, collapsing the Terra ecosystem.

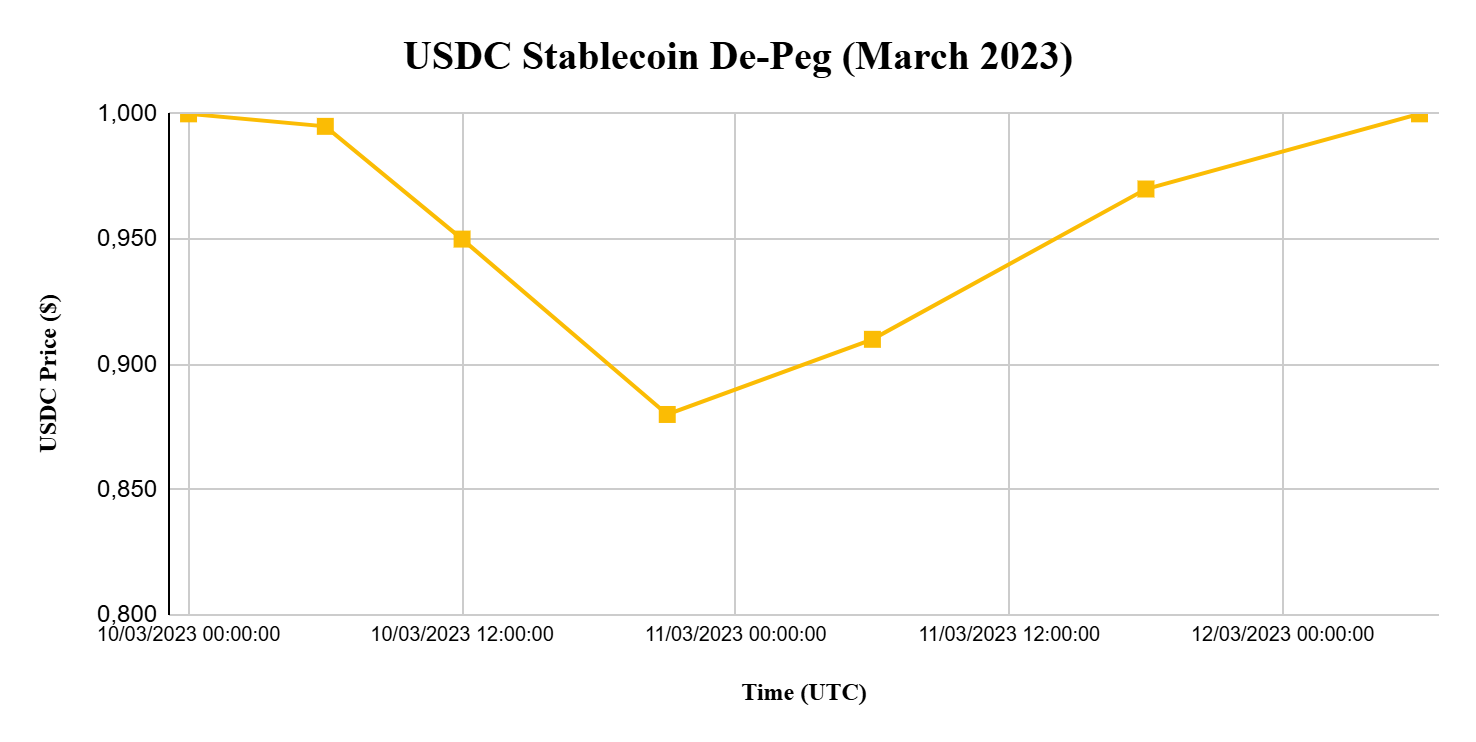

2. USDC (Circle USD) - A fiat-backed stablecoin, with each USDC backed by USD held in banks/financial institutions (supposedly the safest way to back a stablecoin).

How it happened:

On March 10, 2023, Silicon Valley Bank (SVB)-which held part of Circle's reserves-suffered a bank run. Circle revealed that almost 10% of USDC reserves were stuck at SVB, prompting panic. USDC briefly fell to $0.87.[2]

Resolution:

The next day, U.S. regulators announced that all SVB depositors would be made whole, restoring confidence and returning USDC to $1. This episode sparked debate on reserve management/transparency and regulation.

Smart-Contract Vulnerabilities

Stablecoins depend on smart contracts for minting, burning, peg mechanics, and redemption. Code can fail.

Potential bugs:

- Flaws in mint/burn logic allowing unlimited minting and market dumping.

- Oracle manipulation: if price feeds are manipulated, users might mint against mispriced collateral.

- Governance upgrades: if governance is compromised, critical functions can be altered.

Illustrative exploits:

- Wormhole Bridge (2022) - $320M stolen: a verification bypass enabled minting wrapped assets without locking real collateral, then bridging back for real ETH.[5]

- Nomad Bridge (2022) - $190M stolen: an upgrade error let transactions pass verification without proof; many copied the exploit. Stablecoins (USDC, DAI, FRAX, USDT) were among stolen assets.

- Euler Finance (2023) - $200M stolen: a flash-loan-aided sequence exploited a position-health check bug, enabling collateral redemption without debt repayment across multiple pools (including DAI, USDC).

| Category | Vulnerability | Description | Example |

|---|---|---|---|

| De-Peg Risk | Collateral shortfall | Stablecoin lacks sufficient backing (fiat or crypto) to maintain peg | USDT (early-days concerns), algorithmic USDT concerns |

| De-Peg Risk | Algorithmic failure | Code-based mechanisms (rebasing, mint/burn) fail under stress | UST/LUNA collapse |

| De-Peg Risk | Market liquidity shock | Large sell-offs push price below the peg | USDC or DAI during extreme volatility |

| Smart-Contract Exploit | Logic flaws | Contract design errors (e.g., missing health checks) | Euler Finance hack |

| Smart-Contract Exploit | Bridge vulnerabilities | Cross-chain transfer contracts drained due to improper validation | Nomad bridge hack |

| Smart-Contract Exploit | Oracle manipulation | Manipulated price feeds affect minting/liquidations | Harvest Finance, Cream Finance exploits |

| Smart-Contract Exploit | Flash-loan attacks | Instant large loans used to exploit protocol logic or collateral | Euler, Cream, other DeFi hacks |

How Stablecoin Yields Are Generated

All stablecoins can be used in DeFi to generate yield. There are generally seven ways of achieving this:

1. Lending

You deposit stablecoins into a lending protocol. Borrowers post collateral and pay interest; that interest is shared between lenders and the protocol. Rates float with supply/demand.[6]

Examples:

- Aave: lend USDC to earn ~4% APY; borrowers pay ~5% APY; the spread goes to the protocol.

- Hyperlend: lend USDT to earn ~11% APY; borrowers pay ~17% APY; both sides may earn bonus points.

2. Liquidity Providing

You deposit stablecoins into a DEX pool. Traders pay fees per swap; fees are distributed to liquidity providers (LPs).[7] Some protocols add token/point incentives.

Examples:

- Deposit $100k into a USDC/DAI pool. If monthly volume is $1B at 0.05% fees, the pool earns $500k; with a 0.1% share, you'd earn ≈$500 (~6% APY if sustained).

- Curve 3pool: historically ~3-15% APY depending on volume/incentives.

3. Market Maker Vaults

You deposit stablecoins into managed pools on DEXs (e.g., Hyperliquid, Extended). The vault market-makes and handles liquidations. Depositors earn a share of trading and liquidation fees; strategies may also capture funding/maker rebates.

Examples:

- Hyperliquid HLP Vault: earns trading fees (0.025% taker, -0.002% maker rebates), funding, and liquidation profits; ~13.4% APR (June 2025); 4-day lock-up.

- Extended Vault: actively quotes across Extended markets, earning 50% of net exchange fees plus its own maker rebates; ~30% APR on top of Extended points.

4. Looping

You borrow against your deposit and re-deposit repeatedly to amplify yields-sometimes automated via flash loans or leverage.

⚠️ Risk Warning: Looping is a high-risk strategy that amplifies both gains and losses. It's especially vulnerable to de-peg events - if your borrowed stablecoin de-pegs while your collateral remains stable, you face significant liquidation risk and potential losses that can exceed your initial deposit.

Examples:

- MorphoLabs Looping: deposit USDC (4-10% APY), borrow USDT, re-deposit, and repeat; P2P matching can improve rates.

- Contango: automates looping (up to 80% APR) via flash loans; borrowing against Pendle PTs can enhance returns.[8]

5. Funding Rates Yield

Protocols run delta-neutral positions in perpetual futures to earn funding paid by traders and pass yields to holders (e.g., via staking/rebasing).[9]

Examples:

- Ethena: hedges futures markets to generate yield.

- Aegis IM (sYUSD): ~15% APR by capturing funding.

- Resolv: earns from staking ETH and hedging.

6. Bootstrapping Liquidity

Provide stablecoins to new/growing protocols to establish on-chain liquidity; earn high initial yields or token rewards (points/airdrops).

Examples:

- Katana: incentivizes stablecoin liquidity with APYs up to 20% plus token rewards.

- PlasmaFDN: deposit USDT/USDC/DAI/USDS into Plasma's Ethereum vault to earn "units" that guarantee allocation to purchase XPL in the public sale.

7. Pendle

Pendle tokenizes yield: split deposits into Principal Tokens (PTs) and Yield Tokens (YTs). Hold PTs for fixed returns, trade YTs for variable yield, or LP PT/YT for fees plus incentives.[10]

Examples:

- Pendle USDC Pool: PT+YT can yield ~18% APR; LPing can push APY >20%.

- Pendle cUSDO (OpenEden): around 12% PT APY with extra rewards.

Airdrop Incentives

Across all methods above, protocols often add incentives (governance tokens, points, future allocations). These can significantly amplify effective yields-but are speculative and depend on market conditions, protocol success, and distribution timelines.

Examples:

- Resolv: base ~10-15% APR from staking/hedging; with governance-token airdrops, effective APY could reach 20-30%.

- Extended Vault: ~30% APR from fees/liquidations; points redeemable for future tokens could boost to 35-45%.

- Pendle: pools often earn high points per unit of liquidity vs. other venues, increasing total rewards.

Academic Insight

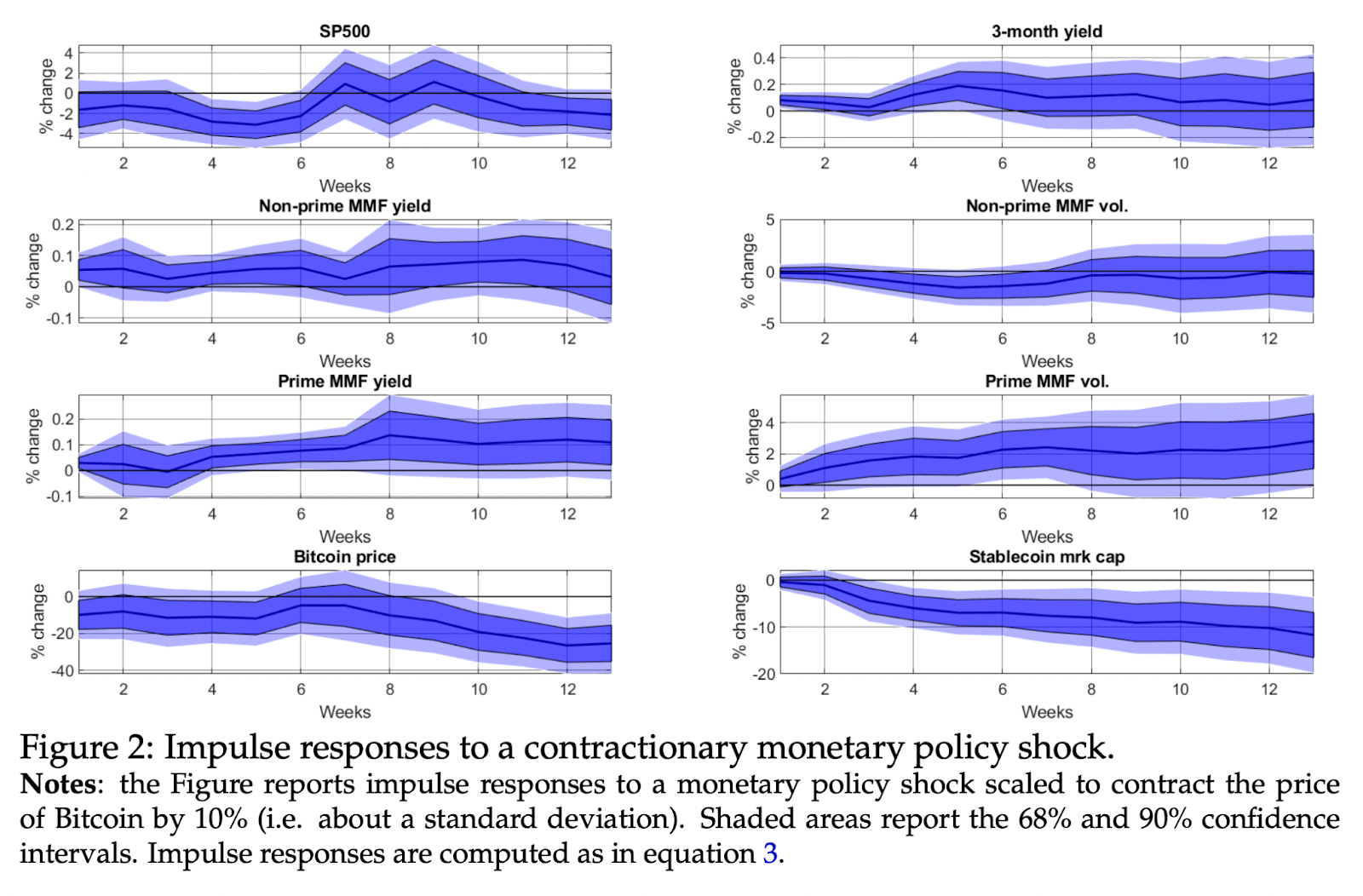

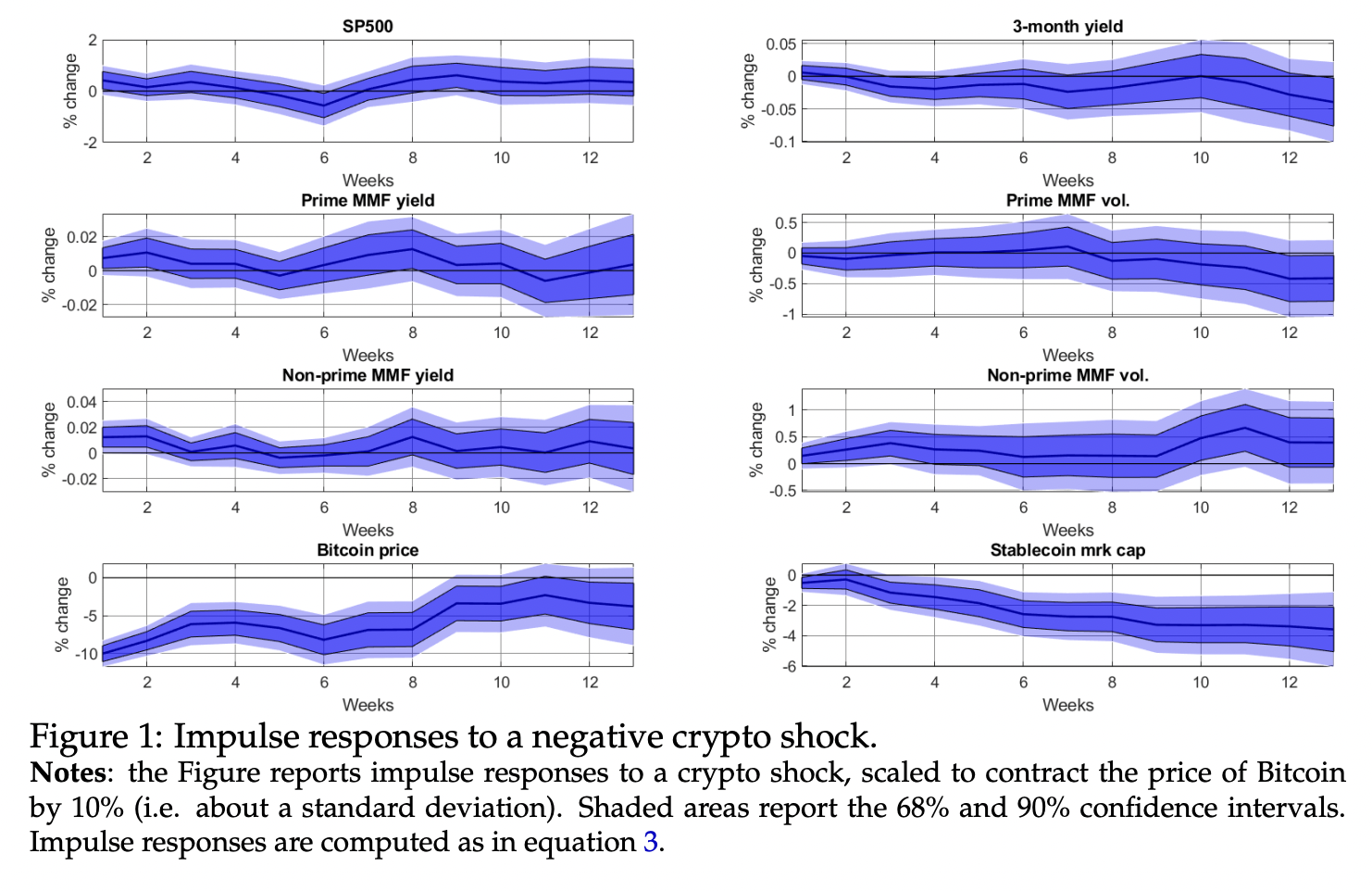

Interest in stablecoins within academic circles continues to grow, particularly concerning their connections to traditional finance. A noteworthy example is "Stablecoins, Money Market Funds, and Monetary Policy" by Aldasoro et al., where the authors illustrate that the demand for stablecoins reacts distinctly from money market funds (MMFs) to macroeconomic shocks.[11] MMFs often expand when U.S. policy rates rise, as higher yields attract investments. In contrast, stablecoin market caps typically contract, reflecting reduced crypto activity post-macro shocks (fewer speculative opportunities on-chain) and the fact that most stablecoins do not pass policy-rate yields on to end users.

Additionally, the study shows no significant impact on traditional markets or MMFs from crypto shocks - the demand for stablecoins declines without spilling over to TradFi.

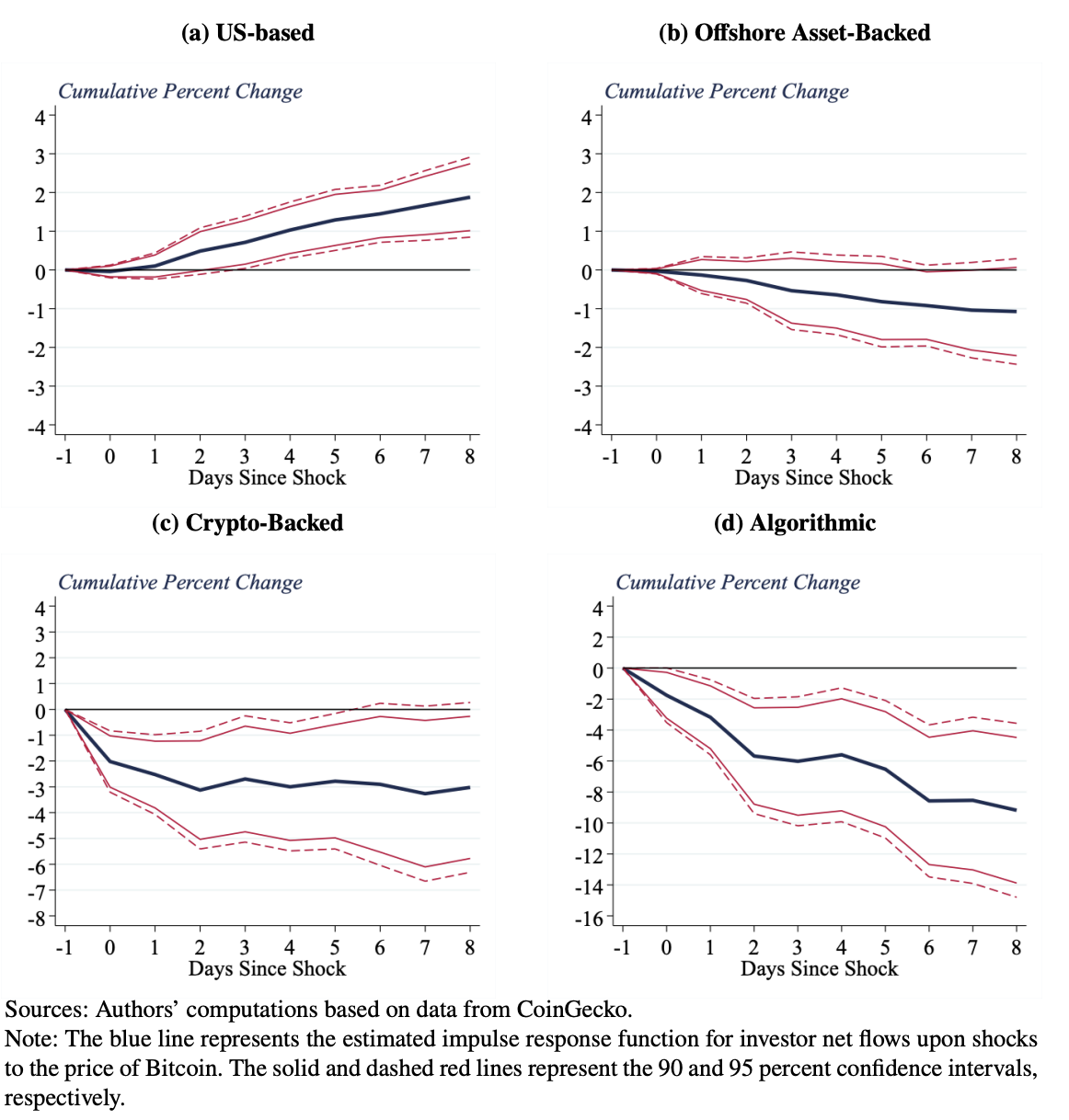

Building on this, "Runs and Flights to Safety: Are Stablecoins the New Money Market Funds?" documents a clear "flight to quality" within stablecoins.[12] During crypto stress episodes, flows systematically shift towards coins perceived as safer - those with clearer reserve backing, stronger redemption channels, and better transparency. Riskier or less transparent designs experience outflows and, at times, temporary or permanent de-pegging (as seen with TerraUSD/Luna). Importantly, these flights to quality are crypto-native and occur even when broader money markets remain calm.

In conclusion, stablecoins are not inherently speculative, but their usage and resilience are influenced by:

- Monetary policy (yield differentials versus off-chain cash-like instruments)

- Crypto market conditions (transactional demand and risk appetite)

- Stablecoin design and governance (reserve composition, transparency, redemption mechanics, and legal structure)

Both papers highlight that stablecoins sit at the intersection of traditional and cryptocurrency markets. However, with increasing regulatory clarity and more institutions entering the space, these findings might become less relevant as the line between traditional and cryptocurrency markets continues to blur.

Future Outlook

In an earlier section, we explored how stablecoins can generate yield as a strong alternative to traditional financial tools. Looking ahead, the divide between traditional and decentralized finance will likely narrow. Regulation will serve as both a gatekeeper and a catalyst for growth. Frameworks like MiCA[13] in the EU and the GENIUS[14] Act in the U.S. will standardize reserve quality, licensing, and transparency, enabling major fintechs and payment processors to integrate stablecoins seamlessly. Asset managers and fintech platforms are already testing tokenized treasuries and short-term funds, creating yield-bearing tools that complement stablecoins. These allow businesses to manage treasury operations on-chain, from liquidity management to automated payouts.[15]

Innovation is also accelerating in payments and settlements. With improved wallets, on-ramps, and compliance, stablecoins will offer fast, low-cost, and reliable transfers, establishing them as a trusted alternative to traditional payment methods rather than a niche crypto product. In the near term, expect seamless bank-to-wallet transfers[16], clearer issuer disclosures, and enhanced wallet experiences, such as simplified gas fee handling or protection against scam transactions. Use cases like remittances, creator payouts, and small e-commerce purchases will scale first, prioritizing stability and low costs. Businesses will increasingly adopt stablecoins for invoicing and settlements when speed and efficiency surpass cards or wire transfers.[17]

In the medium term, stablecoins will unlock their potential as programmable money, enabling innovations like streaming salaries, usage-based payments, and smart-contract-linked transactions, such as delivery milestones or time-locked funds. Cross-chain transfers will become seamless, with users sending their preferred stablecoins while apps manage the complexity. In the long term, stablecoins will stand alongside cards and bank transfers in global commerce, supported by robust compliance tools for tax, accounting, and reporting.

| Trend | Impact on Stablecoins |

|---|---|

| Regulatory Clarity | MiCA and GENIUS Act standardize operations, boosting fintech trust and adoption. |

| Tokenized Treasuries | On-chain T-bills and funds create new yield opportunities for businesses. |

| Payment Innovation | Fast, low-cost transfers drive remittances, payouts, and e-commerce growth. |

| Programmable Money | Streaming salaries and smart contracts enable automated, flexible transactions. |

| Global Integration | Stablecoins join traditional payments with compliance tools for tax and reporting. |

These trends highlight the need for infrastructure that supports efficient, secure, and scalable stablecoin transactions. Plasma, a blockchain purpose-built for stablecoins, addresses these challenges with zero-fee USDT transfers, deep liquidity, and EVM compatibility, positioning it as a key player in the future of decentralized finance.

Plasma Blockchain

Plasma is an EVM-compatible Layer 1 built to make stablecoin payments feel like sending a message: instant, low-fee, and simple, without asking users to learn new tools. You keep your usual Ethereum wallet and apps; Plasma handles the payment flow: zero-fee USDT transfers, fees payable in stablecoins, fast finality for checkout and payroll, a trust-minimized BTC bridge, and optional confidential payments.[18]

In practice, that means smoother onboarding for new users, fewer failed payments at the point of sale, and stable, low costs that make micropayments and subscriptions viable. Builders get the speed and UX needed for consumer apps; users get a “just works” experience that feels like modern fintech.

| Feature | Ethereum | Plasma |

|---|---|---|

| EVM compatibility | ✅ | ✅ |

| Zero-fee USDT transfers | ❌ | ✅ |

| Pay fees in stablecoins | ❌ | ✅ |

| Finality & fees | Can surge under load | Fast finality, low fees |

| Micropayments viability | Often pricey | Designed for small payments |

| Onboarding UX | Must buy native gas first | Use stablecoins from day one |

| Merchant checkout | Multi-step / variable fees | Fewer steps / predictable costs |

| BTC interoperability | External bridges | Trust-minimized BTC bridge |

| Optional privacy | Limited at L1 | Confidential payments (opt-in) |

Made by team DefiDeviants

Sources

- CoinGecko. 2024. State of Stablecoins 2024. https://assets.coingecko.com/reports/2024/CoinGecko-State-of-Stablecoins-2024.pdf

- Reuters. 2023. "Circle Reveals $3.3 Billion SVB Exposure; USDC Breaks Dollar Peg." March 11, 2023. https://www.reuters.com/business/crypto-firm-circle-reveals-33-bln-exposure-silicon-valley-bank-2023-03-11/

- Circle. 2025. "USDC Risk Factors." https://www.circle.com/legal/usdc-risk-factors

- Tether. 2025. "Legal / Terms." https://tether.to/legal/

- Chainalysis. 2022. "The Wormhole Hack (February 2022)." https://www.chainalysis.com/blog/wormhole-hack-february-2022/

- Aave. n.d. "Interest-Rate Strategy (Utilization Model)." https://aave.com/docs/developers/smart-contracts/interest-rate-strategy

- Uniswap. 2021. "Uniswap v3 Whitepaper (Concentrated Liquidity)." https://app.uniswap.org/whitepaper-v3.pdf

- Contango. n.d. "How Does It Work?" https://docs.contango.xyz/basics/how-does-it-work

- Binance Academy. 2023. "What Are Funding Rates in Crypto Markets?" https://academy.binance.com/en/articles/what-are-funding-rates-in-crypto-markets

- Pendle. n.d. "Pendle Docs — Introduction." https://docs.pendle.finance/Introduction

- Aldasoro, I., et al. 2024. "Stablecoins, Money Market Funds and Monetary Policy." BIS Working Paper 1219. Bank for International Settlements. https://www.bis.org/publ/work1219.pdf

- Anadu, K., et al. 2024. "Runs and Flights to Safety: Are Stablecoins the New Money Market Funds?" Staff Report 1073. Federal Reserve Bank of New York. https://www.newyorkfed.org/research/staff_reports/sr1073

- European Union. 2023. Markets in Crypto-assets Regulation (MiCA), Regulation (EU) 2023/1114. EUR-Lex. https://eur-lex.europa.eu/eli/reg/2023/1114/oj/eng

- U.S. Congress. 2025. GENIUS Act. https://www.congress.gov/bill/119th-congress/senate-bill/1582/text

- BlackRock. 2024. "BUIDL: Tokenized Fund Launch." Business Wire, March 20, 2024. https://www.businesswire.com/news/home/20240320771318/en/BlackRock-Launches-Its-First-Tokenized-Fund-BUIDL-on-the-Ethereum-Network

- Visa. 2025. "Visa Expands Stablecoin Settlement Support." July 31, 2025. https://investor.visa.com/news/news-details/2025/Visa-Expands-Stablecoin-Settlement-Support/default.aspx

- PayPal. 2023. "PayPal Launches U.S. Dollar Stablecoin (PYUSD)." August 7, 2023. https://newsroom.paypal-corp.com/2023-08-07-PayPal-Launches-U-S-Dollar-Stablecoin

- Plasma. 2025. "Start Here — Introduction." Plasma Docs. https://docs.plasma.to/docs/get-started/introduction/start-here